Electronic invoicing is slowly transforming into a reality in the current business world and especially in the Saudi Arabia market. As the trend of digital transformation steps up, more organizations are opting for e-invoicing solutions for better efficiency, lesser paper work and compliance with country laws. The Transition to e-invoicing in Saudi Arabia also helps in the billing and fortifying cash flow so that the businesses are capable of handling the issues of the environments in which they operate.

There are numerous opportunities and challenges that Riyadh based firms and firms all across the Kingdom of Saudi Arabia face while implementing e-invoicing. It is always useful to understand what steps have to be taken to increase the likelihood of a successful transition which is the case of this digital strategy. The following tips highlighted below shall help the business to overcome these challenges as it progresses through the change to e-invoicing as well as adopt new regulations to enhance the efficiency of the business.

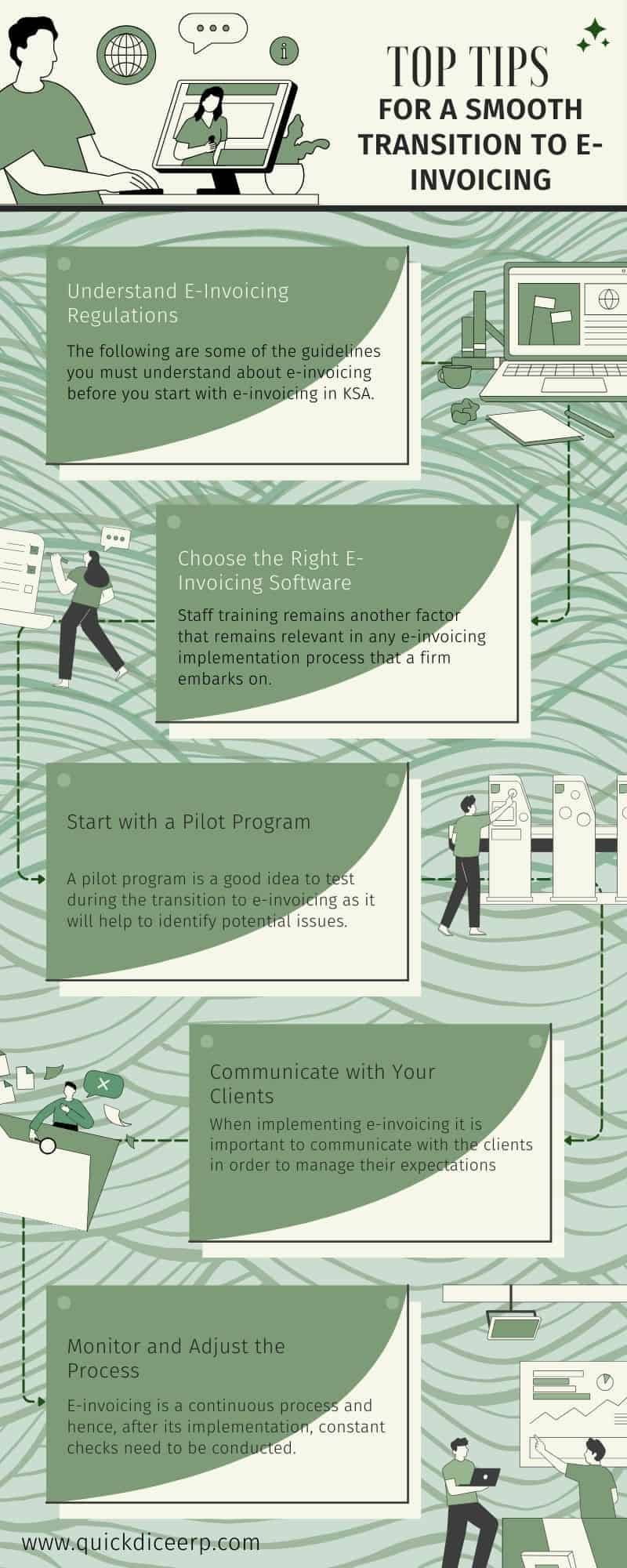

Here are the Top Tips for a Smooth Transition to E-Invoicing

1. Understand E-Invoicing Regulations

The following are some of the guidelines you must understand about e-invoicing before you start with e-invoicing in KSA. For example, the body that is responsible for taxes in Saudi has put in place measures that any business has to meet. Other regulations include; In regard to preparation of the invoice the format to be used, the kind of information that has to be included and manner in which the invoices are to be presented.

It is important to know these legal requirements because otherwise you will end up paying penalties and you will have certainty that your e-invoicing is legal. The legal necessities that are associated with e-invoicing will only be understood by the businesses in Riyadh when they venture into this technology.

2. Choose the Right E-Invoicing Software

Choosing appropriate e-invoicing software is one of the major activities in this change process. What you need is something that will address your needs within the company but it should not affect your accounting software. Among them are; usability, compatibility aspects and upgradability aspects. Any good e-invoicing system will always select the right processes that should minimize these gaps and enhance the handling of invoices. E-invoicing is still in its infancy among businesses in Saudi Arabia, and Riyadh in specific; the appropriate application of e-invoicing will strongly contribute to the improvement of the organizational process and rules compliance in the organizations that will implement the technology.

3. Train Your Staff

Staff training remains another factor that remains relevant in any e-invoicing implementation process that a firm embarks on. It is also quite clear that your team should also be aware of new process and the technologies to be used. It is recommended to arrange some kind of meetings that would help the employees get to know the e-invoicing software, what measures should be taken before, during and after using the e-invoicing software, as well as other things about e-invoicing.

The staff who will have embraced the new system will also be in a position to embrace the new system hence improving the general change. As more organizations adopt e-invoicing in Riyadh, having a well-trained team will also be a competitive factor apart from improving the operation performance of the organizations.

4. Start with a Pilot Program

A pilot program is a good idea to test during the transition to e-invoicing as it will help to identify potential issues. And if you choose to implement the e-invoicing system within a particular department or for a particular type of transactions, you will know the areas that might require some adjustments before introducing the system for all other departments or other types of transactions.

The above strategy helps one to get feedback from the users in order to effect some changes in the system in order to enhance its effectiveness. A pilot program is of great significance for the companies in Saudi Arabia that are aiming to implement e-invoicing without overloading their staff or clients. It becomes a working progress towards guaranteeing continuity.

5. Communicate with Your Clients

When implementing e-invoicing it is important to communicate with the clients in order to manage their expectations. Let them know the new changes and give them the tools to enable them know how the new process will be like. This way, any issue your clients may have will be erased and a good working relationship will be established. When making the proposal, do not forget to mention the advantages of e-invoicing like time efficiency, greater accuracy and so on. Effective client communication during e-invoicing implementation in Riyadh and across Saudi Arabia will strengthen business relationships and experiences.

6. Monitor and Adjust the Process

E-invoicing is an ongoing process. After implementation, conduct regular checks to ensure everything runs smoothly. It is important to get feedback from the personnel, and the clients, to establish what problems may exist or what needs improvement. This way, you should review the process frequently so that you can note the changes you need to make to improve the e-invoicing system. Such a continuous adaptation is especially relevant for Saudi Arabian enterprises because the rules and conditions are likely to change at some point. Therefore, it is possible to argue that by keeping a proactive approach, it is possible to improve the e-invoicing even further as regards the companies’ operations.

7. Ensure Data Security

Security of financial data is important especially when implementing e-invoicing. Make certain that the e-invoicing software you select comes with adequate security measures in place to prevent loss of data and unauthorized access to it. It’s important to change your security measures from time to time, and educate your employees on how to protect the data. Since more and more companies in Riyadh are implementing e-invoicing, emphasizing data protection will not only meet legal requirements but also help to gain confidence in customers and partners. Thus, a well-developed security system will strengthen the reliability of the e-invoicing operations.

Conclusion:

Adapting to e-invoicing is a giant leap towards the improvement of operations efficiency and compliance for organizations in Saudi Arabia especially the cities of Riyadh. Regulations, choosing the right software, and training the staff are the ways through which organisations can embark on this digital change without any worry. Communication with the clients and constant supervision of the process also guarantee that companies get maximum profit from e-invoicing and, as a result, receive better cash flow and decreased expenses.

So, for e-invoicing to play a more important role in the Saudi market, companies that adapt to the change will stand themselves for future success. Based on the guidelines mentioned above, it is possible to ensure efficient transition to e-invoicing in Riyadh so that the further development of corporate relations with clients becomes more efficient. The first effect relates to compliance with international standards; the second relates to the need to adhere to the principles of innovation in the context of a rapidly developing modern world.